Transparency

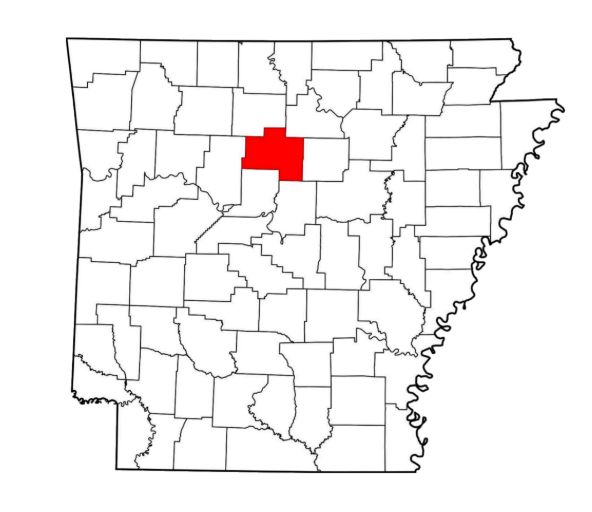

Van Buren County ranks 6th in Arkansas for government transparency, up from 19th in 2018.

We’re proud of that progress. Our goal is simple: to keep county business open and easy for everyone to see. From local decisions to public records, we believe information should be available to the people it serves.

Fiscal:

-

-

-

-

-

-

-

Property Sales Tax Rates

The median property tax in Van Buren County, Arkansas is $403 per year for a home valued at the median of $79,200. On average, the county collects 0.51% of a property's assessed fair market value as property tax.

Van Buren County Tax Assessor

The Van Buren County Tax Assessor is responsible for assessing the taxable value of all properties in the county. They determine the amount of tax due based on the fair market value of the property.

The Assessor’s Office can help you with:

Property Tax Appraisals

The Assessor appraises each property yearly based on its features and the value of similar properties in the area. You can request a copy of your most recent appraisal from the Assessor’s Office.

Property Renovations and Re-Appraisals

If you renovate your property (for example, adding living space, bedrooms, or bathrooms), the Assessor will re-appraise it to reflect the increased value. Renovations may be reported by the zoning board, contractors, or the homeowner. Unreported renovations are usually found during the next on-site appraisal. A re-appraisal may also occur if the property is significantly damaged.

Paying Your Property Tax

The Assessor’s Office can:

Provide a copy of your property tax assessment

Show you your property tax bill

Help you pay your property taxes or set up a payment plan

Note: Payments are typically made to the county tax collector or treasurer, not the assessor.

Homestead Exemptions

You can apply for the Van Buren County homestead exemption through the Assessor’s Office. This offers a modest tax break for primary residences. Other exemptions may be available for:

Farmland

Green space

Veterans

Others (call for details)

Property Tax Appeals

If you believe your property is over-assessed, the Assessor’s Office can:

Provide a tax appeal form

Explain the appeal process

If your appeal is approved, your property value—and tax amount—will be adjusted.

For more details about property taxes in Van Buren County, or to compare tax rates across Arkansas, visit the Van Buren County property tax page.

-

The Van Buren County Sales Tax is 1.5%

A county-wide sales tax rate of 1.5% is applicable to localities in Van Buren County, in addition to the 6.5% Arkansas sales tax.

Some cities and local governments in Van Buren County collect additional local sales taxes, which can be as high as 1.625%.

Here’s how Van Buren County’s maximum sales tax rate of 9.625% compares to other counties around the United States:

Lower maximum sales tax than 79% of Arkansas counties

Higher maximum sales tax than 86% of counties nationwide

-

-

-

-

Administrative

-

-

-

Pam Bradford-County Clerk

(501) 745-6995

vbcoclerk@artelco.com

1414 Hwy 65 S, Ste 128

Clinton, AR 72031 -

-

-

-

-

-

-

Political

-

The Van Buren County Quorum Court meets the third Thursday of each month at the Van Buren County Courthouse Annex located at 1414 Highway 65 South in Clinton, Arkansas. All other information regarding the court can be found here. Click Here

-

COUNTY JUDGE

The County Judge is the chief executive officer of county government in Arkansas. As the county’s executive, the judge:

Authorizes and approves the spending of all county funds.

Oversees county roads.

Enforces ordinances passed by the Quorum Court.

Manages county property.

Accepts grants from federal, state, public, and private sources.

Hires county employees (except those working under other elected officials).

Presides over the Quorum Court without a vote, but with veto power.

(ACA 14-14-1101 – 1102)

The County Court, presided over by the County Judge, acts in a judicial capacity and has original jurisdiction in matters such as:

County Taxes – property assessments, tax levies, collections, and distribution.

Paupers – county-funded services for indigent residents.

Local Improvements – projects related to county finances, infrastructure, and economic development.

Other matters not transferred to the judge’s executive role by Amendment 55 or removed by Amendment 67.

(ACA 14-14-1105)

The County Judge also coordinates daily operations between local, state, and federal agencies, applies for state and federal funds, and appoints members to county boards—some requiring Quorum Court confirmation.

COUNTY SHERIFF

The County Sheriff is the county’s chief law enforcement officer. The sheriff:

Maintains public peace and manages the county jail.

Executes court orders, summons, and warrants.

Attends court sessions and assists with juries, witnesses, and prisoners.

Works with prosecutors to prepare evidence for criminal cases.

Transports prisoners and individuals to state facilities.

Quells disturbances, arrests offenders, and enforces laws.

(ACA 12-41-502, 14-15-501, 14-14-1301)

The sheriff also collaborates with municipal, state, and federal law enforcement agencies.

COUNTY CLERK

The County Clerk serves as the official bookkeeper for county government and clerk for the county, quorum, and probate courts. Key duties include:

Maintaining financial accounts between the Treasurer and the county.

Preparing checks for approved county payments.

Keeping complete records of county financial transactions.

(ACA 16-20-402)

As secretary to the Quorum Court, the clerk records all meeting minutes, ordinances, and resolutions.

(ACA 14-14-902, 14-14-903)The clerk also:

Maintains probate, adoption, and guardianship records.

Serves as secretary to the Board of Equalization.

May prepare county tax books.

(ACA 26-27-307, 26-28-101–108)

Under Amendment 51, the clerk is the official voter registrar, maintaining voter registration, absentee ballots, and early voting. The clerk issues marriage licenses, maintains business incorporation records, and assists the election commission in conducting elections.

(ACA 7-5-401 et seq., ACA 9-11-201, ACA 4-26-1201)CIRCUIT CLERK

The Circuit Clerk serves as clerk for the circuit and juvenile courts and usually acts as the ex-officio recorder for the county.

Maintains court records and dockets.

Issues summons, warrants, judgments, and other court orders.

Keeps files on all pending and past court cases.

(ACA 16-20-102, 16-20-303)

The Circuit Clerk also:

Administers the jury list.

Records deeds, mortgages, and other property instruments.

Swears in notaries public and files professional regulations.

(ACA 14-15-401, 16-32-101 et seq.)

COUNTY COLLECTOR

The County Collector is responsible for collecting all property taxes—county, municipal, school, and district.

Collects taxes from March 1 through October 15 each year.

Transfers collected funds to the County Treasurer at least monthly.

Applies a 10% penalty to delinquent taxes not paid by October 15.

Publishes a list of delinquent taxpayers before December 1 annually.

(ACA 26-39-201, 26-35-501, 26-36-201–203)

COUNTY ASSESSOR

The County Assessor appraises and assesses all taxable property:

Real property between January and July 1.

Personal property between January and May 31.

(ACA 26-26-1101, 26-26-1408)

All property is assessed based on its value as of January 1 each year. The assessor also maintains up-to-date property records and submits assessment books to the County Equalization Board by August 1.

(ACA 26-26-715)COUNTY TREASURER

The County Treasurer serves as the county’s disbursement officer and custodian of funds.

Receives and distributes tax collections, grant funds, and other revenues.

Signs and issues checks for authorized county payments.

Maintains detailed accounting of all receipts and disbursements.

(ACA 14-15-807, 14-24-204)

The Treasurer reports monthly to the Quorum Court and collects a small commission on funds processed through the office, except for certain funds exempt by law.

(ACA 14-20-105, 21-6-302)COUNTY CORONER

The County Coroner investigates and determines the cause and manner of deaths within the county.

On-call 24/7/365 to investigate deaths.

Reviews medical and background information to determine cause of death.

(ACA 14-15-301)

QUORUM COURT

The Quorum Court is the county’s legislative body, composed of Justices of the Peace elected from districts within the county. Depending on population, there may be 9, 11, 13, or 15 members.

The Quorum Court:

Meets monthly to pass ordinances and resolutions.

Is presided over by the County Judge (who has veto power but no vote).

Can override a veto with a 3/5 vote.

(ACA 14-14-801 et seq., 14-14-901 et seq.)

Its powers include:

Levying taxes.

Appropriating funds.

Fixing compensation for county officers and employees.

Filling vacancies in county offices.

Contracting with other governments for public services.

Maintaining peace and order in county affairs.

COUNTY SURVEYOR

The County Surveyor establishes and verifies property boundaries, resolves land disputes, and inspects timber operations.

(ACA 14-15-702, 15-32-201)CONSTABLE (TOWNSHIP)

A Constable is an elected township officer, not a county officer. The constable preserves peace within the township and must meet training, uniform, and vehicle requirements to access state law enforcement systems or carry a firearm.

(ACA 16-19-301, 14-14-1314)AMENDMENT 95

In the 2016 General Election, Arkansas voters approved Amendment 95, extending county elected official terms from two years to four years.

Beginning with the 2018 General Election, the following offices serve four-year terms:County Judge

Sheriff

Circuit Clerk

County Clerk

Assessor

Coroner

Treasurer

County Surveyor

Collector of Taxes

Amendment 95 also prohibits county officers from being appointed or elected to another state civil office during their elected term.

-

-